Econ-ML

A repository of papers that bring machine learning into economics and econometrics curated by John Coglianese, William Murdock, Ashesh Rambachan, Jonathan Roth, Elizabeth Santorella, and Jann Spiess

Machine Learning for Price Targeting

Jean-Pierre Dubé and Sanjog Misra (2017): Scalable Price Targeting. NBER Working Paper.

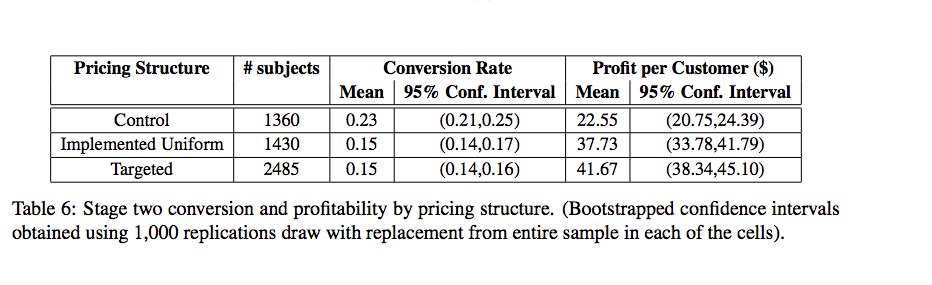

This paper show how firms can use price experiments in combination with ML techniques to target prices for particular consumers, thereby increasing profits. The authors conduct two RCTs on the website of an online recruiting firm, Ziprecruiter.com. In the first RCT, they randomly assign the offered price for the firm’s service and observe consumer take-up. They then use ML techniques to predict consumer price sensitivity from this RCT – in particular, they use a so-called Bayesian Lasso to obtain not just a point-estimate of consumer price-sensitivity, but also a posterior distribution. For any given consumer, they can then determine the price that maximizes profits over the estimated posterior of price sensitivity. They then run a second RCT to test whether price-targeting according to this algorithn actually increases firm profits. The treatment group in the second RCT is assigned targeted prices, whereas the control group receives a fixed price. Overall, they find that profits increase by over 10% under the targeting scheme.

Highlight: The following table shows that implementing price targeting increases profits substantially both relative to the firm’s benchmark price (Control), as well as relative to the optimal uniform price as indicated by their price experiment (Implemented Uniform).

price targeting

Reviewed by Jon on .